Noncommutative & irreducible

a−a+b−b=0a+b−a−b≠0

An organon of economic theory, contra Foucault, is that—just as a gas is nothing more than a composite of molecules—so is “a society” nothing more than a composite of individuals. (Although individuals vary considerably more than do atoms; a gas molecule can be characterised with only a handful of numbers.) “‘Society’ does not exist”—if I cared to google some more, I could I think find utterances by Prime Minister Thatcher, Alan Greenspan, Russ Roberts, and Ayn Rand, to this effect.

Is that rubbish? I only specialise in stage 17 of the industrial-steel treatment process because other people have specialised in stages 16 and 18. But if we tossed out Cartesian decomposability, we’d be tossing out science (=reductionistic experimental method), and mathematics, and logic itself … right?

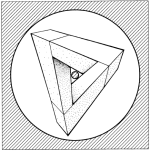

Here with the Borromean rings, as with cohomology elments, we get an example of a global property which is lost at the local level. Nothing is special about any of the individual rings. It’s the way they combine that’s special—not an independent Cartesian product, but a thoroughly intermeshed interlinking. The whole is more than the sum of the parts.

Not saying that the world is Borromean or something as simplistic as that. But just like Cantor’s laughably small example of a three-part system (ω,ω²,π∙ω) disproved Nietzsche’s unfounded assertion (in The Eternal Return) that “Any complex system must return to its original state” (naïve conception of infinity) without suggesting that Society is a three-part system,—we might take the existence of a tiny primitive with global-non-local properties as at least evidence against the Great Organon, and possibly pointing the way toward a theory in which “society” can have a meaning beyond “collection of individuals”.

Echoes of financial crisis. If you removed 30% of the banksters (and attorneys) from the problem centres (wherever they were!) in the instigation of the financial crisis, would we have averted an O($10 trillion) destruction of wealth? Or is it the incentives (echoes of Richie/Rosen’s “entailment structures”)? Or the “culture” (and can we give this meaning?) in which Gordon Gekko-worshipping

acolytes of capitalism buy and resell a Panglossian view of price-as-value-added where success comes only to those who serve the most? vision of capitalism—if indeed that replaced some earlier less casino-like culture to investment banking (http://www.tubechop.com/watch/923989).

But this sounds too vague and hand-wavy. A dystopian “system” that controls free-willed individuals? Constituted of “military-industrial-lobbying-banking complexes” and shadowy networks of faceless vice-presidents—but when one asks those who propound this woolly claptrap to point to specifics or give an atomistic description of what they think is going on, they can’t! Proving of course that their accusations are baseless.

Where could anyone ever hope to find the tools to make a rigorous theory out of it?